0 Comments

1 category

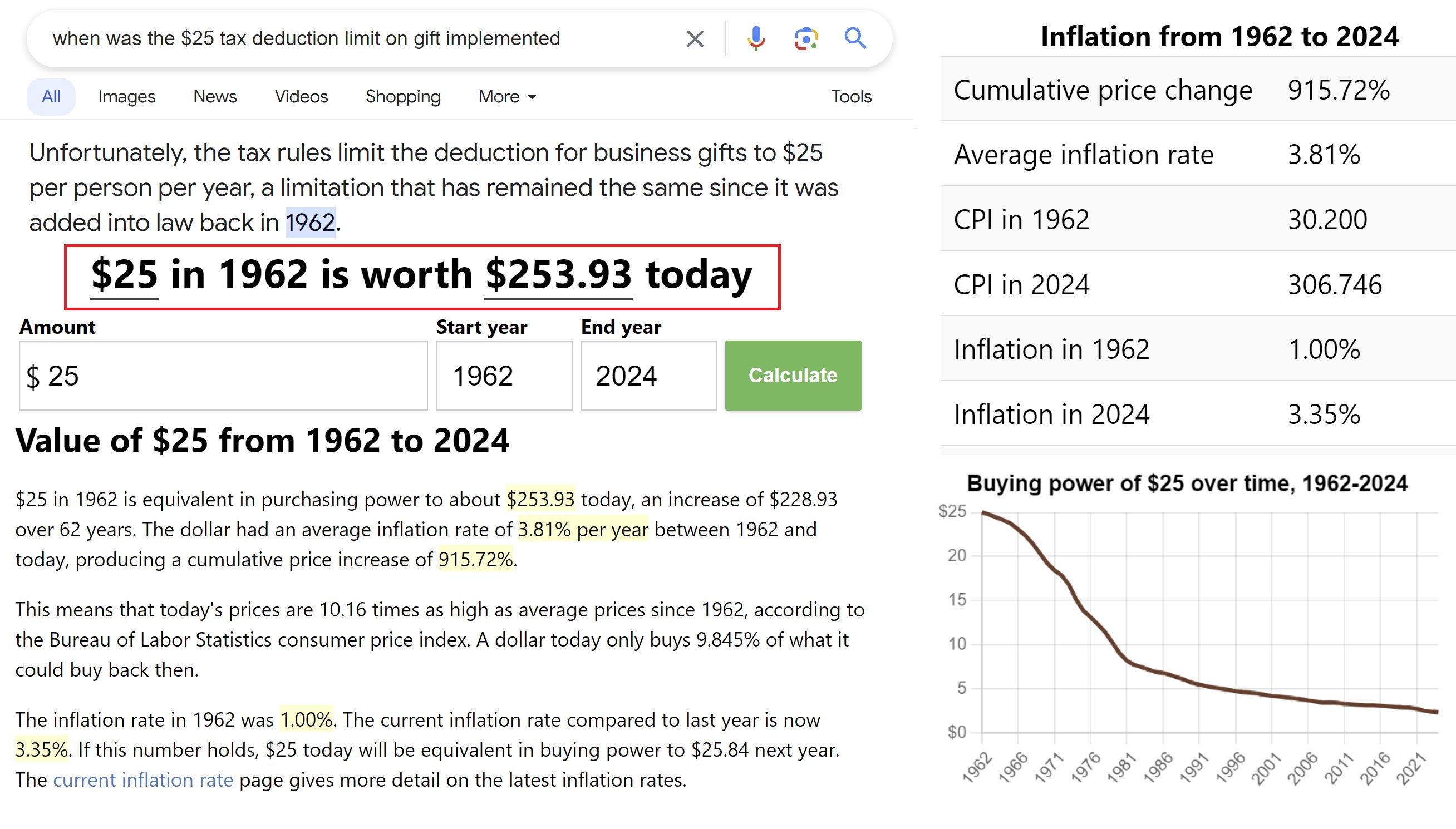

Business Gifts Deduction 2024 Limits – Note that this $10,000 limit is a cumulative lifetime limit. Usually, annual contributions to any individual above a certain threshold ($18,000 in 2024, up from $17,000 in 2023) would count against . Taxpayers often push the limits to save on their taxes. Here are some unusual deductions the IRS has allowed taxpayers to take. Do any pertain to you? .

Business Gifts Deduction 2024 Limits

Source : www.tangiblevalues.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comLopata, Flegel & Company LLP | St. Louis MO

Source : www.facebook.comTone Vays on X: “Take a look at this ridiculous Tax Deduction

Source : twitter.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comAre Corporate Gifts Tax Deductible?

Source : www.bestowegifting.comVan Beek & Co., LLC | Tigard OR

Source : m.facebook.comChloe Flanders Nutritionist Workout Anytime Franchising

Source : www.linkedin.comPublication 463 (2023), Travel, Gift, and Car Expenses | Internal

Source : www.irs.govWQRG 96.3FM Diamondhead | Kiln MS

Source : www.facebook.comBusiness Gifts Deduction 2024 Limits 2024 Important Tax Changes Brochure IMPRINTED (25/pack) Item : Taking advantage of these often overlooked tax deductions can help you lower your tax bill. . There is good news from the IRS this year. The standard deduction that people are allowed to take has gone up. .

]]> Category: 2024